Winter 2023: Wellbeing and Your Wallet Index Findings

Affinity Federal Credit Union released findings from the debut installment of its Wellbeing and Your Wallet Index. The Index captures consumer sentiment around their overall financial wellbeing, a cornerstone of the culture within Affinity’s community, and analyzes results from a 42-question survey completed by 3,001 individuals in New Jersey, New York, Connecticut and Pennsylvania.

The survey, which was completed in Dec. 2022, addressed key financial wellbeing concerns impacting consumers, including addressing mounting inflation concerns on everyday spending and budgeting and access to financial education and resources.

Key findings include:

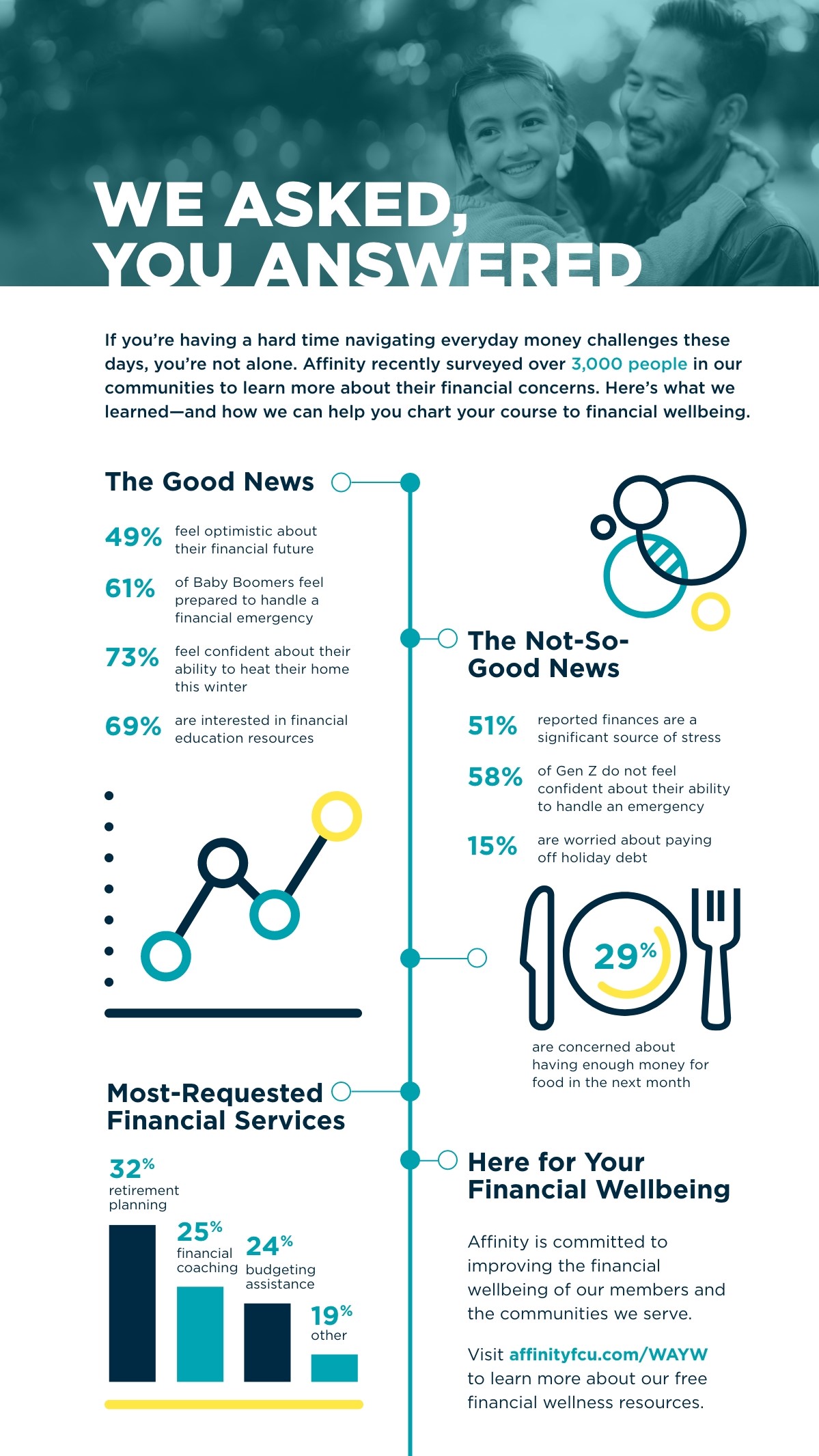

Despite ongoing headwinds, consumers’ financial optimism is high. Forty-nine percent of respondents indicated they are optimistic about their financial futures, with Generation Z reporting the highest levels of optimism (59%). The data showcases resilience among consumers despite ongoing headwinds of inflation, economic pullback concerns and market volatility.

The majority of older generation respondents feel well-prepared for financial emergencies. Fifty-four percent felt confident in their ability to handle the cost of an emergency situation, with older generations statistically more confident in their ability to handle such situations (78% of the Silent Generation and 61% of Baby Boomers). Conversely, only 42% of Generation Z respondents felt confident in their ability to handle an emergency situation.

Financial concerns continue to be a significant contributor to stress levels, particularly for younger generations. Over half (51%) of respondents feel finances are a significant source of stress, with Millennials (64%) and Gen Z (61%) respondents reporting financial stress at a higher rate. More specifically, 29% of respondents reported concern about having enough money for food in the next month (Jan. 2023), with millennials most concerned (39%).

Consumers show heightened interest in financial education, but access remains limited. Forty-two percent of respondents were not aware of financial education services or content available through their primary financial institution. Over two-thirds of respondents (69%) were interested in learning more about key financial education topics, including retirement planning (32%), financial coaching (25%) and budgeting assistance (24%).

“We are encouraged by the results of the Winter Wellbeing and Your Wallet Index, showing increased consumer confidence in their financial futures,” said Jacqui Kearns, Chief Brand and Wellbeing Officer of Affinity. “However, we see financial concerns, including inflation and food security, continue to drive stress among younger people and negatively impact their financial wellbeing. Our goal is to identify these stressors and provide education, support and services that would positively impact the communities we serve.”

Grant Gallagher, Head of Financial Wellbeing at Affinity, added: “It's clear that there is still a need for more education around finance to ensure consumers are equipped with the knowledge and resources to achieve peace of mind. We are committed to helping our members take control of their futures and guiding them on how to make smart decisions with their money.”

The Winter 2023 edition is the first installment of quarterly surveys and data releases to assess changes in sentiment and financial wellbeing over time. Affinity partnered with Drive Research for the survey.

Media Contact

Alex George

Gregory FCA for Affinity Federal Credit Union

affinity@gregoryfca.com

610-228-2104